The cryptocurrency market has experienced significant growth in recent years, attracting investors from diverse backgrounds. As the market continues to evolve, it’s essential for investors to stay informed about the top crypto investment strategies. With the rise of digital assets, investors are presented with opportunities to diversify their portfolios and potentially generate substantial returns. Effective investment strategies can help mitigate risks and maximize gains. By understanding the most effective approaches, investors can make informed decisions and navigate the complex world of cryptocurrency investing with confidence and precision, ultimately achieving their financial goals.

Mastering Crypto Investment: A Comprehensive Guide

The world of cryptocurrency investment is rapidly evolving, with new opportunities and challenges emerging every day. To navigate this complex landscape, it’s essential to stay informed about the latest trends and strategies. By learning top crypto investment strategies, you can make more informed decisions and potentially maximize your returns. Whether you’re a seasoned investor or just starting out, understanding the intricacies of crypto investment is crucial for success.

Understanding Market Trends

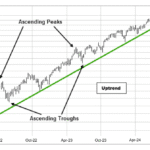

Understanding market trends is vital in crypto investment, as it allows you to make informed decisions about when to buy, sell, or hold your assets. By analyzing market data and trends, you can identify patterns and anticipate potential price movements. This involves staying up-to-date with market news, analyzing charts, and using technical indicators to gauge market sentiment. Market volatility is a key characteristic of the crypto market, and being able to navigate this volatility is essential for successful investment.

Diversification and Risk Management

Diversification is a key strategy in crypto investment, as it allows you to spread your risk across different assets and reduce your exposure to market volatility. By investing in a range of cryptocurrencies, you can potentially reduce your losses and increase your gains. Effective risk management involves setting clear investment goals, diversifying your portfolio, and using strategies such as stop-loss orders to limit your potential losses.

Long-Term vs Short-Term Investing

When it comes to crypto investment, one of the key decisions you’ll need to make is whether to adopt a long-term or short-term investment strategy. Long-term investing involves holding onto your assets for an extended period, potentially riding out market fluctuations in anticipation of long-term growth. In contrast, short-term investing involves actively buying and selling assets in response to market movements, with the goal of making quick profits.

Understand blockchain impact on financial markets

Understand blockchain impact on financial markets| Investment Strategy | Description | Risk Level |

|---|---|---|

| Long-Term Investing | Holding onto assets for an extended period | Medium |

| Short-Term Investing | Actively buying and selling assets in response to market movements | High |

| Dollar-Cost Averaging | Investing a fixed amount of money at regular intervals | Low-Medium |

Maximizing Returns: Expert Insights into Crypto Investment Strategies

To diversify your portfolio and potentially maximize returns, it’s essential to understand the various crypto investment strategies available, including those that focus on long-term growth, short-term gains, and risk management.

Understanding Market Trends

Analyzing market trends and staying up-to-date with the latest crypto market news is crucial for making informed investment decisions, allowing you to identify opportunities for growth and profit.

Diversification Techniques

Implementing effective diversification techniques, such as spreading investments across different asset classes and sectors, can help mitigate risk and increase potential returns in the volatile crypto market.

Risk Management Strategies

Employing risk management strategies, including setting stop-loss orders and using position sizing, can help protect your investments from significant losses and maintain a stable portfolio.

Long-Term Investment Approaches

Focusing on long-term investment approaches, such as hodling and dollar-cost averaging, can help investors ride out market fluctuations and potentially benefit from the long-term growth of their chosen cryptocurrencies.

Analyze market trends before investing money

Analyze market trends before investing moneyTechnical Analysis

Utilizing technical analysis tools and techniques, including chart patterns and indicators, can help investors identify trading opportunities and make more informed decisions about when to buy and sell their crypto assets.

Frequently Asked Questions

What are the most profitable crypto investment strategies?

The most profitable crypto investment strategies include dollar-cost averaging, diversification, and long-term holding. These strategies help mitigate risks and maximize returns. Investors can also consider staking, lending, and yield farming to generate passive income. It’s essential to stay informed about market trends and adjust your strategy accordingly to achieve success in the crypto market.

How do I get started with crypto investment?

To get started with crypto investment, begin by educating yourself on the basics of cryptocurrency and blockchain technology. Open an account on a reputable exchange, and fund it with a secure payment method. Start with a small investment and gradually increase it as you gain experience. It’s crucial to set a budget, diversify your portfolio, and stay updated on market news to make informed investment decisions.

What are the risks associated with crypto investment?

Crypto investment carries several risks, including market volatility, security risks, and regulatory uncertainty. Prices can fluctuate rapidly, resulting in significant losses if not managed properly. Investors must be cautious of phishing scams, exchange hacks, and other security threats. Staying informed about market trends and regulatory changes can help mitigate these risks and ensure a more secure investment experience.

Can I invest in crypto with a small budget?

Yes, you can invest in crypto with a small budget. Many exchanges offer the ability to buy fractions of a coin, allowing you to start with a minimal investment. It’s essential to choose a reputable exchange with low fees and to be mindful of the risks associated with investing in cryptocurrency. A small budget requires careful planning and a well-thought-out strategy to achieve success in the crypto market.

Maximize your profits with crypto trading

Maximize your profits with crypto trading