Investing money can be a daunting task, especially for those who are new to the world of finance. With so many options available, it can be difficult to determine where to put your hard-earned cash. One crucial step in making informed investment decisions is analyzing market trends. By understanding the current market landscape and identifying patterns, investors can make more informed decisions and minimize potential risks. A thorough analysis of market trends can help investors navigate the complex world of finance and make smart investment choices that align with their financial goals. Accurate market analysis is essential.

Understanding Market Trends to Make Informed Investment Decisions

Analyzing market trends before investing money is a crucial step that can significantly influence the success of your investments. Market trends refer to the direction in which the market is moving, and understanding these trends can help investors make informed decisions. By analyzing market trends, investors can identify opportunities, manage risk, and potentially increase their returns. It involves examining historical data, current market conditions, and forecasting future trends to make educated guesses about where the market is headed.

Identifying Key Market Indicators

To analyze market trends effectively, it’s essential to identify key market indicators. These indicators can include economic data such as GDP growth rates, inflation rates, and unemployment rates. Economic indicators provide valuable insights into the overall health of the economy and can signal potential shifts in market trends. Other indicators include market sentiment, which can be gauged through investor surveys and put-call ratios, and technical indicators such as moving averages and relative strength index (RSI).

Analyzing Historical Data and Current Conditions

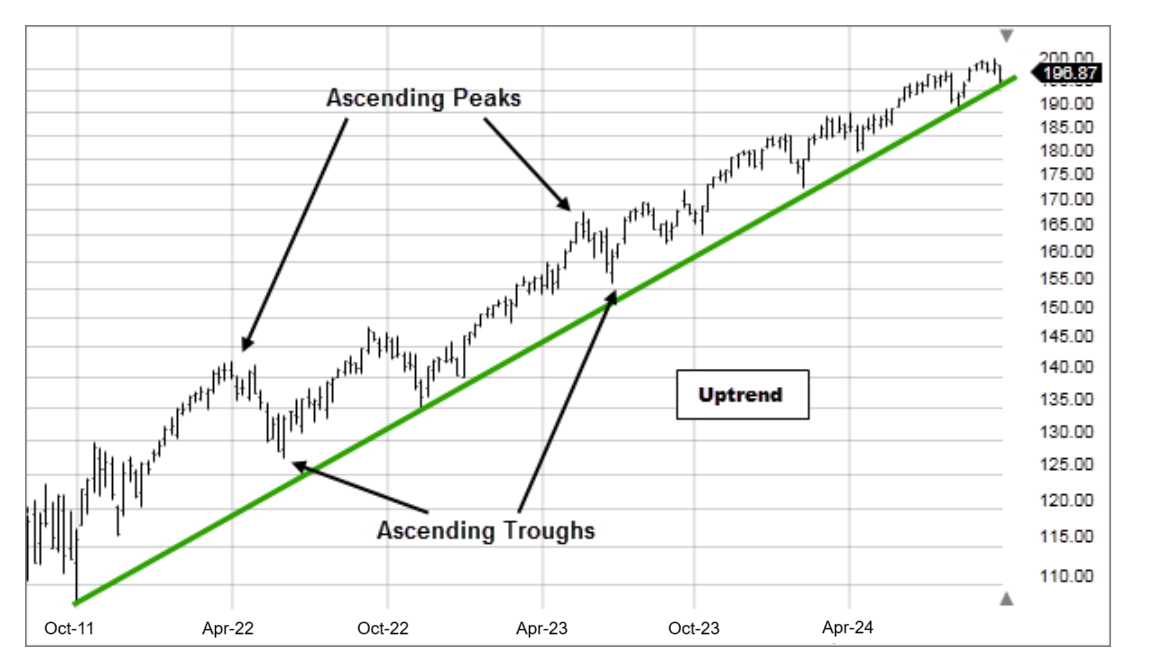

Analyzing historical data is a critical component of understanding market trends. By examining how markets have behaved in the past under various conditions, investors can gain insights into how they might behave in the future. This involves looking at historical price movements and understanding the factors that drove those movements. Additionally, assessing current market conditions, including the overall economic environment and geopolitical events, is vital for making informed investment decisions.

Forecasting Future Market Trends

Forecasting future market trends involves using the insights gained from analyzing historical data and current conditions to predict where the market is headed. This can be done through various methods, including technical analysis, fundamental analysis, and quantitative analysis. Investors use these methods to identify emerging trends and potential investment opportunities. By staying ahead of the curve, investors can position themselves to capitalize on future market movements.

Maximize your profits with crypto trading

Maximize your profits with crypto trading| Indicator Type | Description | Importance |

|---|---|---|

| Economic Indicators | GDP growth rates, inflation rates, unemployment rates | High – Reflects the overall health of the economy |

| Market Sentiment | Investor surveys, put-call ratios | Medium – Indicates investor attitudes towards the market |

| Technical Indicators | Moving averages, Relative Strength Index (RSI) | High – Helps in identifying trends and potential reversals |

Understanding Market Trends for Informed Investment Decisions

Analyzing market trends before investing money is crucial as it enables investors to make informed decisions, mitigating potential risks and maximizing returns on their investments by understanding the direction in which the market is heading.

Identifying Emerging Trends

To analyze market trends effectively, it’s essential to identify emerging trends early on, which involves monitoring industry developments, consumer behavior, and technological advancements that could impact the market, allowing investors to capitalize on new opportunities.

Assessing Market Volatility

Understanding market volatility is vital, as it refers to the rate at which the price of an asset increases or decreases for a given set of returns, and investors need to assess this volatility to gauge the level of risk associated with their investments.

Analyzing Competitor Activity

Competitor analysis is another key aspect of analyzing market trends, where investors examine the strategies and performance of their competitors to understand the competitive landscape and make informed decisions about their investments.

Evaluating Economic Indicators

Economic indicators such as GDP growth rate, inflation rate, and employment rates play a significant role in shaping market trends, and investors need to evaluate these indicators to understand the overall health of the economy and make predictions about future market movements.

Secure your crypto wallet from hacks

Secure your crypto wallet from hacksUtilizing Data Analytics Tools

The use of data analytics tools is becoming increasingly important in analyzing market trends, as these tools enable investors to process large amounts of data quickly and efficiently, providing them with valuable insights that can inform their investment decisions.

Frequently Asked Questions

Why is it crucial to analyze market trends before investing money?

Analyzing market trends helps investors make informed decisions, minimizing potential losses. By understanding the direction and momentum of the market, investors can identify opportunities and risks. This analysis enables them to adjust their investment strategies accordingly, ensuring they are better positioned to achieve their financial goals.

What are the key market trends to analyze before investing?

Key market trends to analyze include overall market direction, industry performance, and specific stock or asset trends. Investors should also examine economic indicators, such as GDP growth, inflation rates, and interest rates, as these can significantly impact market performance. Understanding these trends helps investors make more accurate predictions about future market movements.

How can I effectively analyze market trends for investment decisions?

To effectively analyze market trends, investors can use a combination of technical and fundamental analysis. Technical analysis involves studying charts and patterns to identify trends, while fundamental analysis examines economic and financial data to assess a company’s or asset’s value. Staying informed through financial news and market reports also helps investors stay up-to-date on the latest trends.

Can analyzing market trends guarantee successful investments?

Analyzing market trends is a crucial step in making informed investment decisions, but it does not guarantee success. Market trends can be unpredictable, and even with thorough analysis, unforeseen events can impact investments. However, by understanding market trends, investors can make more informed decisions, reducing the risk of losses and increasing the potential for successful investments.

Learn top crypto investment strategies today

Learn top crypto investment strategies today