Managing personal finances effectively is crucial for achieving financial stability and security. One key aspect of financial management is tracking expenses, which enables individuals to understand where their money is being spent and make informed decisions about their financial resources. By monitoring expenses, individuals can identify areas of unnecessary expenditure and make adjustments to optimize their financial situation. Effective expense tracking is essential for creating a realistic budget, reducing debt, and building savings. It is a fundamental step towards taking control of one’s finances and achieving long-term financial goals.

Effective Strategies for Tracking Expenses to Control Your Finances

Tracking expenses is a crucial step in managing your finances effectively. By keeping a close eye on where your money is going, you can identify areas where you can cut back and make adjustments to achieve your financial goals. In today’s consumerist society, it’s easy to overspend without even realizing it, but with the right tools and mindset, you can take control of your financial situation.

Understanding the Importance of Expense Tracking

Expense tracking is not just about recording every single transaction; it’s about gaining insight into your spending habits and making informed decisions. By categorizing your expenses, you can see where your money is going and identify patterns or areas of unnecessary expenditure. This knowledge empowers you to make budgeting decisions that align with your financial objectives.

Use apps to simplify budget management

Use apps to simplify budget management| Expense Category | Monthly Spend | Percentage of Income |

|---|---|---|

| Housing | $1,500 | 30% |

| Food | $800 | 16% |

| Transportation | $300 | 6% |

Tools and Methods for Effective Expense Tracking

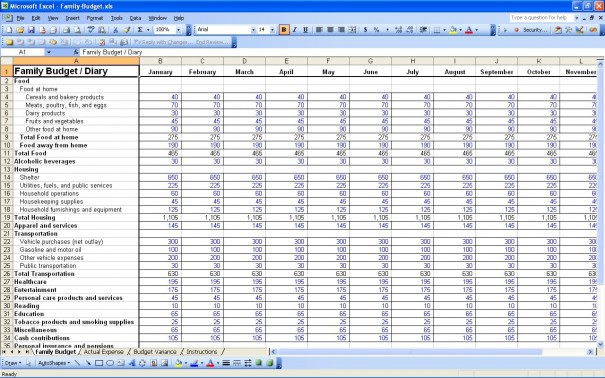

There are numerous tools and methods available for tracking expenses, ranging from mobile apps like Mint and Personal Capital to spreadsheet templates. The key is to find a system that works for you and stick to it. Regularly updating your expense tracker ensures that you have a clear and accurate picture of your financial situation at any given time.

| Tracking Method | Pros | Cons |

|---|---|---|

| Mobile Apps | Automatic expense categorization, real-time updates | Potential data security risks, dependency on technology |

| Spreadsheet Templates | Customizable, offline access | Manual entry required, less automated |

Analyzing and Adjusting Your Spending Habits

Once you have a clear picture of your expenses, the next step is to analyze your spending habits and make necessary adjustments. This might involve cutting back on non-essential expenses, finding ways to reduce necessary expenses, or allocating more funds towards savings and debt repayment. By regularly reviewing and adjusting your budget, you can ensure that you’re on track to meet your financial goals.

| Adjustment Strategy | Potential Savings | Implementation Difficulty |

|---|---|---|

| Reducing Dining Out | $200/month | Easy |

| Negotiating Bills | $100/month | Moderate |

Frequently Asked Questions

Why is tracking expenses important for financial control?

Tracking expenses helps you understand where your money is going and identify areas of unnecessary spending. By monitoring your expenses, you can create a realistic budget, prioritize your spending, and make informed financial decisions. This enables you to manage your finances effectively, reduce debt, and achieve your long-term financial goals.

Adjust budgets according to financial changes

Adjust budgets according to financial changesHow can I effectively track my expenses?

To track expenses effectively, record every transaction, no matter how small, in a notebook, spreadsheet, or mobile app. Categorize your expenses into needs and wants, and set a budget for each category. Regularly review your expenses to identify trends and areas for improvement. Automating expense tracking through digital tools can also simplify the process and reduce errors.

What are the benefits of using digital tools to track expenses?

Using digital tools to track expenses offers several benefits, including increased accuracy, convenience, and efficiency. Digital tools can automatically categorize transactions, generate reports, and provide real-time updates. They can also help you set budgets, receive alerts, and make informed financial decisions. Additionally, digital tools can simplify tax preparation and provide a clear picture of your financial situation.

How often should I review my expenses to control my finances?

Review your expenses regularly to stay on top of your finances. Set aside time weekly or monthly to analyze your spending, identify trends, and adjust your budget as needed. Regular reviews help you detect areas of overspending, make adjustments, and stay focused on your financial goals. This enables you to respond promptly to changes in your financial situation and make informed decisions.

Prioritize spending to avoid financial stress

Prioritize spending to avoid financial stress