Financial fluctuations can significantly impact personal and business budgets, necessitating timely adjustments to maintain fiscal stability. As economic conditions evolve, it is crucial to reassess financial plans and make necessary changes to accommodate new circumstances. This involves revising budget allocations, identifying areas of potential cost savings, and adapting to shifting financial priorities. By doing so, individuals and organizations can mitigate the effects of financial changes and ensure long-term sustainability. Effective budget adjustment is a vital skill in today’s dynamic economic environment, enabling entities to respond to challenges and capitalize on opportunities.

Adjusting Budgets in Response to Financial Fluctuations

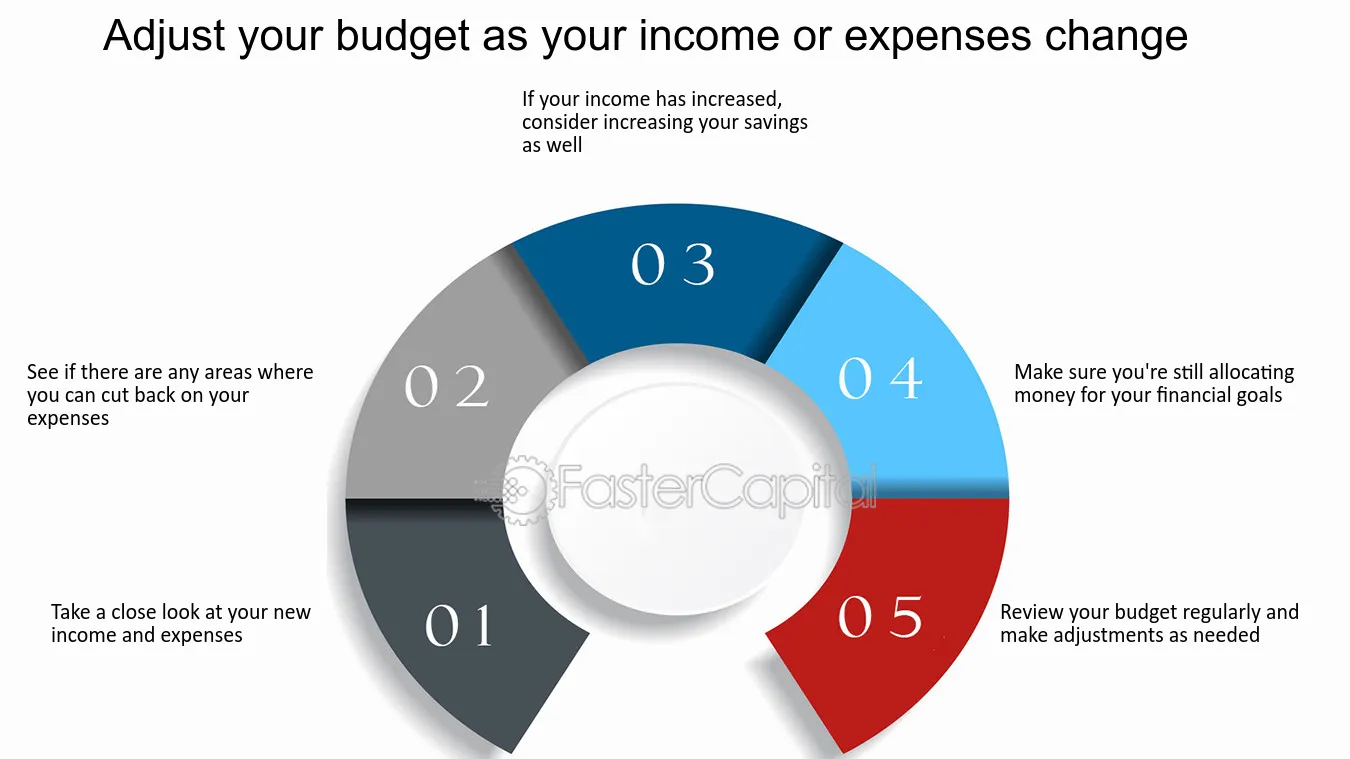

In today’s dynamic economic environment, financial changes can occur suddenly and unexpectedly, impacting individuals and organizations alike. It is crucial to be proactive and adjust budgets accordingly to maintain financial stability. Adjusting budgets in response to financial fluctuations involves a thorough review of current financial standings, identification of areas that require adjustment, and implementation of necessary changes to ensure alignment with new financial realities.

Assessing Financial Changes

Assessing the nature and extent of financial changes is the first step in adjusting budgets. This involves analyzing changes in income, expenses, and other financial factors to understand their impact on the overall financial situation. It is essential to identify the sources of financial changes, whether they are due to internal factors such as changes in business operations or external factors like economic downturns or market fluctuations. Accurate assessment of financial changes enables the development of effective strategies to mitigate their impact.

Prioritize spending to avoid financial stress

Prioritize spending to avoid financial stress| Financial Change | Impact on Budget | Adjustment Strategy |

|---|---|---|

| Reduced Income | Decreased financial resources | Reduce discretionary spending |

| Increased Expenses | Increased financial strain | Renegotiate contracts or cut operational costs |

Prioritizing Budget Adjustments

Once the financial changes are assessed, the next step is to prioritize budget adjustments. This involves identifying essential expenses that must be maintained, such as salaries, rent, and utilities, and distinguishing them from non-essential expenses that can be reduced or eliminated. Prioritizing budget adjustments ensures that critical financial obligations are met while minimizing the impact of financial changes. It is crucial to focus on cost-saving measures that do not compromise the quality of products or services.

| Expense Category | Priority Level | Adjustment Action |

|---|---|---|

| Essential Expenses | High | Maintain or optimize spending |

| Non-Essential Expenses | Low | Reduce or eliminate |

Implementing Budget Adjustments

Implementing budget adjustments requires careful planning and effective communication. It involves putting into action the strategies developed during the assessment and prioritization phases. This may include reducing costs, reallocating resources, or adopting more efficient financial management practices. Successful implementation of budget adjustments depends on the ability to monitor financial performance closely and make further adjustments as necessary.

| Adjustment Strategy | Implementation Steps | Monitoring Metrics |

|---|---|---|

| Cost Reduction | Identify areas for reduction, implement cuts | Expense ratio, cost savings |

| Resource Reallocation | Assess resource utilization, reallocate as needed | Resource utilization rates, return on investment (ROI) |

Frequently Asked Questions

Why is it necessary to adjust budgets according to financial changes?

Adjusting budgets according to financial changes is necessary to ensure that financial goals and objectives are still achievable. Changes in income, expenses, or other financial factors can impact budget accuracy. By adjusting the budget, individuals and organizations can respond to these changes and make informed financial decisions to stay on track and achieve their financial objectives effectively.

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTube

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTubeHow often should budgets be adjusted according to financial changes?

Budgets should be adjusted regularly to reflect financial changes. The frequency of adjustments depends on the nature and volatility of the financial environment. For individuals and organizations with stable finances, quarterly or semi-annual adjustments may be sufficient. However, in times of significant financial change or uncertainty, more frequent adjustments may be necessary to ensure the budget remains relevant and effective.

What are the key factors that necessitate budget adjustments?

Key factors that necessitate budget adjustments include changes in income, expenses, interest rates, and market conditions. Other factors may include changes in business operations, regulatory requirements, or unexpected events. By monitoring these factors, individuals and organizations can identify the need for budget adjustments and make informed decisions to respond to changing financial circumstances and stay on track with their financial objectives.

How can budget adjustments be made effectively?

Effective budget adjustments involve regularly reviewing financial performance, identifying areas for improvement, and making informed decisions based on changed financial circumstances. This may involve revising budget allocations, adjusting financial projections, or implementing cost-saving measures. By taking a proactive and flexible approach to budget adjustments, individuals and organizations can respond to financial changes and achieve their financial goals.

El Reto del Yate: lujo, aspiración y la fantasía viral que dominó las redes sociales

El Reto del Yate: lujo, aspiración y la fantasía viral que dominó las redes sociales