The cryptocurrency market is known for its volatility, with prices fluctuating rapidly and often without clear explanation. Bitcoin, the largest cryptocurrency by market capitalization, is no exception, experiencing significant price swings that leave investors and observers alike wondering what drives these changes.

Understanding the factors behind Bitcoin’s current price movement is crucial for making informed investment decisions. Various market and economic indicators, along with global events, contribute to the cryptocurrency’s price dynamics. Analyzing these elements can provide insight into whether Bitcoin is likely to continue its current trend or reverse course.

Understanding the Current Bitcoin Price Movement

The price of Bitcoin is influenced by a multitude of factors, making its movement a subject of interest and speculation among investors and enthusiasts alike. The cryptocurrency market is known for its volatility, with prices often experiencing significant fluctuations within short periods.

To understand why Bitcoin is going up or down at any given time, it’s essential to consider various market and economic indicators.

Market Demand and Supply

The fundamental principle of economics, demand and supply, plays a crucial role in determining the price of Bitcoin. When demand is high, and supply is limited, the price tends to rise. Conversely, when demand is low, and there’s a surplus of Bitcoin in the market, the price may drop. Factors such as investor sentiment, global economic conditions, and the adoption rate of Bitcoin influence demand.

Economic and Geopolitical Factors

Economic and geopolitical events have a significant impact on the price of Bitcoin. For instance, economic instability or geopolitical tensions can lead to increased investment in Bitcoin as a safe-haven asset, driving up its price. On the other hand, positive regulatory developments can boost investor confidence, while negative regulatory actions can lead to a decline in price. The interplay between global economic conditions and Bitcoin’s price is complex and multifaceted.

Technical Factors and Market Sentiment

Technical factors, including the halving of Bitcoin block rewards and advancements in blockchain technology, can also influence its price. Moreover, market sentiment, driven by news, trends, and the overall attitude of investors towards risk, plays a critical role. The perception of Bitcoin as a store of value or a speculative investment can significantly affect its price movement. Understanding these factors is crucial for navigating the complexities of the cryptocurrency market.

| Factor | Description | Impact on Bitcoin Price |

|---|---|---|

| Market Demand | Influenced by investor sentiment and global economic conditions | High demand can drive the price up |

| Economic Instability | Can lead to increased investment in Bitcoin as a safe-haven asset | Can drive the price up |

| Regulatory Developments | Positive or negative regulatory actions can significantly impact investor confidence | Positive regulations can boost the price, while negative ones can lead to a decline |

Why is Bitcoin rising right now?

:max_bytes(150000):strip_icc()/what-determines-value-1-bitcoin_final-15193042bd364c798609890610b53902.png)

Bitcoin is rising right now due to a combination of factors that are driving its value upwards. One major factor is the increasing adoption of Bitcoin by institutional investors, who are now more willing to invest in the cryptocurrency due to the growing infrastructure and regulatory clarity.

Institutional Investment

The influx of institutional investment is a significant factor in Bitcoin’s current rise. As more traditional financial institutions and companies begin to invest in Bitcoin, it lends credibility to the cryptocurrency and drives up demand. Some key points to consider about institutional investment in Bitcoin include:

Which Crypto Wallet Is Safest for Long-Term Storage?

Which Crypto Wallet Is Safest for Long-Term Storage?- The entry of large financial institutions into the Bitcoin market has increased liquidity and reduced volatility.

- Institutional investors are bringing a level of professionalism and expertise to the market, which is helping to drive growth.

- The involvement of institutional investors is also leading to the development of new financial products and services related to Bitcoin.

Regulatory Clarity

Regulatory clarity is another important factor contributing to Bitcoin’s rise. As governments and regulatory bodies around the world begin to provide clearer guidelines on the use and trading of cryptocurrencies, it is helping to reduce uncertainty and increase confidence in the market. Some key aspects of regulatory clarity include:

- Clearer regulations are helping to reduce the risk of regulatory crackdowns, which has been a major concern for investors in the past.

- Regulatory clarity is also enabling the development of new financial products and services related to Bitcoin, such as exchange-traded funds (ETFs).

- The provision of clear guidelines is helping to increase transparency and accountability in the cryptocurrency market.

Market Sentiment

Market sentiment is also playing a significant role in Bitcoin’s current rise. As more investors become bullish on the cryptocurrency, it is driving up demand and pushing the price higher. Some key factors influencing market sentiment include:

- The overall trend of the global economy and financial markets is influencing investor sentiment towards Bitcoin.

- Advancements in technology and the development of new use cases for Bitcoin are also contributing to positive market sentiment.

- Media coverage and public perception of Bitcoin are also playing a role in shaping market sentiment and influencing investor decisions.

How much would $100 dollars in Bitcoin be worth today?

To determine the current value of $100 in Bitcoin, we need to look at the current price of Bitcoin. As the price of Bitcoin fluctuates constantly due to market forces, the value of $100 in Bitcoin will also change.

Current Bitcoin Price

The current price of Bitcoin is a crucial factor in determining the value of $100 in Bitcoin. This price is determined by the market forces on cryptocurrency exchanges. To find the current value, we need to know the current price of one Bitcoin. For example, if the current price of one Bitcoin is $50,000, then we can calculate the value of $100 in Bitcoin.

- The current price of Bitcoin can be found on various cryptocurrency exchanges or financial websites.

- The price is usually quoted in US dollars, but it can also be quoted in other currencies.

- The price of Bitcoin is known for its volatility, so it can change rapidly.

Calculating the Value

To calculate the value of $100 in Bitcoin, we divide $100 by the current price of one Bitcoin. Using the example price of $50,000 per Bitcoin, $100 would be equivalent to 0.002 Bitcoins. The actual calculation involves dividing 100 by the current Bitcoin price.

- The calculation is straightforward: $100 / current Bitcoin price.

- The result gives the amount of Bitcoin equivalent to $100.

- This amount will change as the price of Bitcoin changes.

Factors Affecting Bitcoin Price

The price of Bitcoin is influenced by a variety of factors, including supply and demand on cryptocurrency exchanges, global economic conditions, regulatory announcements, and technological developments. Understanding these factors can provide insight into why the price of Bitcoin, and thus the value of $100 in Bitcoin, changes.

- Economic conditions can influence investor appetite for riskier assets like Bitcoin.

- Regulatory changes can significantly impact the price by affecting the legality and ease of buying and selling Bitcoin.

- Technological developments, such as improvements in blockchain technology, can also impact the price.

How much will $1 Bitcoin be worth in 2025?

The question of how much $1 Bitcoin will be worth in 2025 is a complex one, as it depends on various factors such as market trends, adoption rates, and global economic conditions. To provide a comprehensive analysis, it’s essential to consider multiple perspectives.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is influenced by a multitude of factors, including supply and demand, investor sentiment, and global economic conditions. Some of the key factors that could impact Bitcoin’s price in 2025 include:

How Much Money Do You Need to Start Crypto Trading?

How Much Money Do You Need to Start Crypto Trading?- The overall adoption rate of Bitcoin and other cryptocurrencies, which could drive up demand and, subsequently, the price.

- Regulatory developments, such as the introduction of clearer guidelines and laws governing the use of cryptocurrencies, which could impact investor confidence.

- Technological advancements, such as improvements to the Bitcoin protocol or the development of more efficient mining hardware, which could increase the efficiency and security of the network.

Potential Price Drivers

Several potential drivers could contribute to an increase in Bitcoin’s price by 2025. These include:

- Increased institutional investment, as more traditional investors and financial institutions enter the cryptocurrency market.

- Growing mainstream acceptance, as more businesses and individuals begin to use and accept Bitcoin as a form of payment.

- Continued development of the underlying technology, including improvements to scalability and usability.

Challenges and Uncertainties

Despite the potential drivers, there are also several challenges and uncertainties that could impact Bitcoin’s price in 2025. These include:

- Regulatory uncertainty, as governments and regulatory bodies continue to grapple with how to effectively oversee and manage the cryptocurrency market.

- Market volatility, as the price of Bitcoin continues to be subject to significant fluctuations in response to various market and economic factors.

- Security concerns, as the risk of hacking and other security breaches continues to be a major concern for investors and users.

What if I invested $1,000 in Bitcoin 10 years ago?

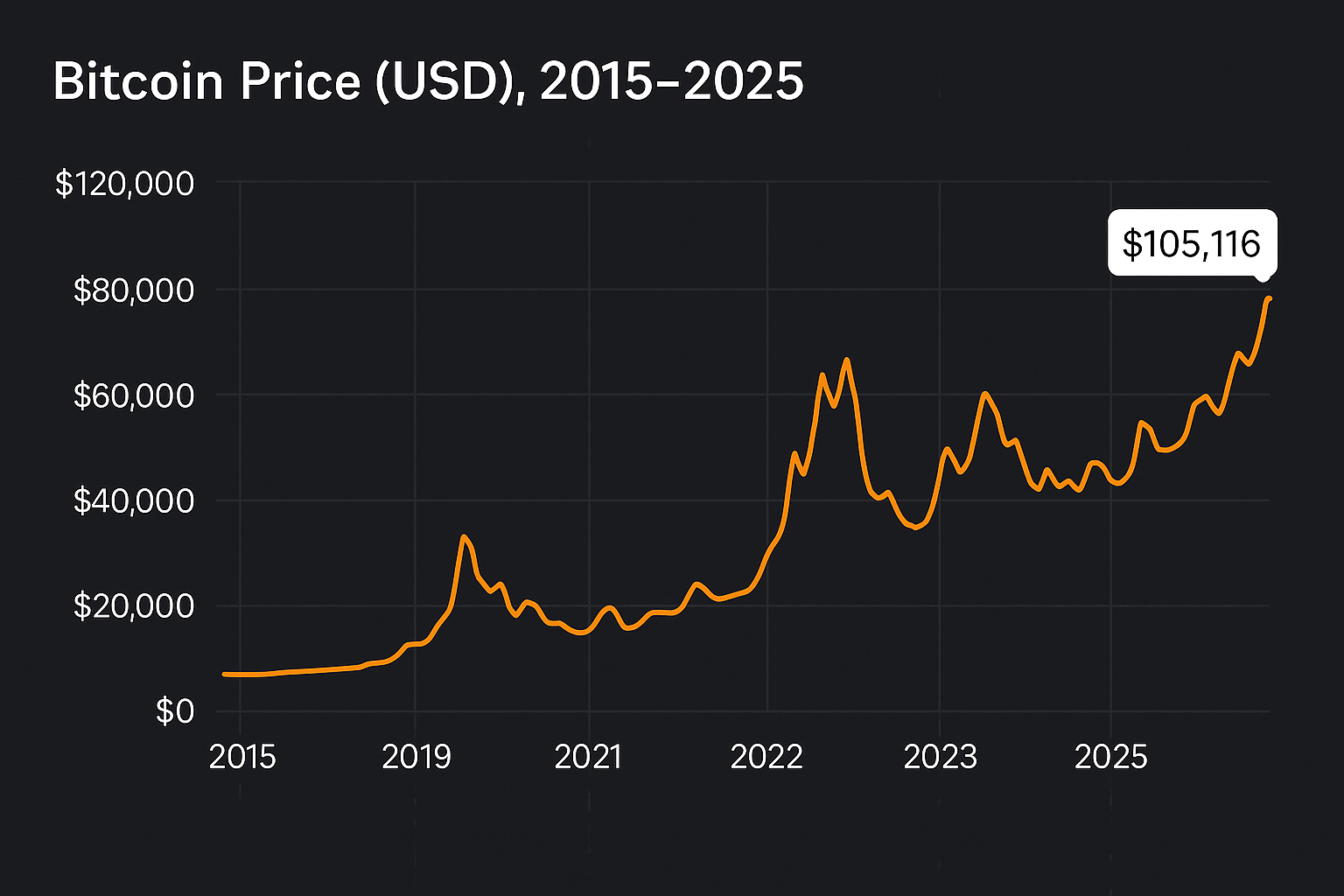

If you had invested $1,000 in Bitcoin 10 years ago, you would be looking at a significantly different financial situation today. To understand the magnitude of this difference, it’s essential to consider the historical price movements of Bitcoin.

Initial Investment and Growth

Investing $1,000 in Bitcoin in 2013 would have bought you a substantial amount of Bitcoin, given its price at the time was around $100-$200 per coin. As Bitcoin’s price began to rise, especially during the 2017 bull run, your initial investment would have grown exponentially. The price of Bitcoin reached nearly $20,000 in December 2017.

- The initial investment of $1,000 would have purchased around 5-10 Bitcoins, depending on the exact price at the time of investment.

- As the price rose, the value of your investment would have increased to tens of thousands of dollars.

- By the end of 2017, your $1,000 investment could have been worth around $100,000 or more.

Long-term Holding and Volatility

Holding onto your Bitcoin investment through the subsequent market fluctuations would have required a significant amount of patience and resilience. Bitcoin’s price has been known for its volatility, with significant price swings occurring over short periods.

- The price dropped significantly after the 2017 peak, falling to around $3,000 in 2018, which would have reduced the value of your investment to around $15,000-$30,000.

- However, for those who held on, the subsequent bull runs, especially the one in 2021, would have again increased the value of their investment.

- By 2021, the price of Bitcoin reached new highs, surpassing $60,000, which would have put the value of your initial $1,000 investment at over $300,000.

Current Value and Considerations

As of the current date, the value of your investment would depend on the current price of Bitcoin and whether you have held onto it or sold it at some point. It’s also worth considering the factors that could influence Bitcoin’s price in the future.

- If you still hold the Bitcoin, its current value would be based on the current market price, which could be significantly different from its historical highs or lows.

- Factors such as regulatory changes, adoption rates, and global economic conditions could all impact the future price of Bitcoin.

- It’s also important to consider the tax implications and potential fees associated with selling or holding cryptocurrency.

Frequently Asked Questions

Why is Bitcoin’s price so volatile?

Bitcoin’s price is volatile due to its relatively small market size, lack of regulation, and speculation. News events, adoption rates, and global economic trends also impact its price. Investors’ emotions and market sentiment play a significant role in price fluctuations. As a result, Bitcoin’s price can surge or plummet rapidly, making it a high-risk, high-reward investment.

What factors influence Bitcoin’s price?

Several factors influence Bitcoin’s price, including supply and demand, adoption rates, global economic trends, and regulatory environments. News events, such as security breaches or government crackdowns, can also impact the price. Additionally, the overall sentiment of investors and market trends contribute to price movements. Understanding these factors can help investors make informed decisions.

Is Bitcoin’s price going to continue to fluctuate?

Yes, Bitcoin’s price is likely to continue to fluctuate due to its inherent volatility. As the cryptocurrency market evolves, new factors will emerge that can impact the price. Regulatory changes, technological advancements, and shifts in investor sentiment will continue to influence Bitcoin’s price. Investors should be prepared for potential price swings and adjust their strategies accordingly.

What Are the Best Crypto Trading Strategies for Beginners?

What Are the Best Crypto Trading Strategies for Beginners?How can I predict Bitcoin’s price movements?

Predicting Bitcoin’s price movements is challenging due to its volatility. Analyzing historical trends, market sentiment, and fundamental factors can provide insights. Technical analysis, such as chart patterns and indicators, can also be useful. However, no method can guarantee accurate predictions. Investors should stay informed, diversify their portfolios, and be prepared for unexpected price movements.