The world of cryptocurrency trading has gained immense popularity in recent years, attracting many new investors and traders. As a beginner, navigating the complex and volatile crypto market can be daunting.

However, with a solid understanding of the basics and a well-thought-out strategy, it is possible to successfully start trading cryptocurrencies. This article aims to provide a comprehensive guide for beginners, covering the essential steps to get started with crypto trading, from understanding the fundamentals to choosing the right exchange and developing a trading plan. Effective knowledge is key.

Getting Started with Crypto Trading as a Beginner

Starting your journey in crypto trading can be both exciting and intimidating. As a beginner, it’s essential to understand the basics of cryptocurrency, the trading process, and the risks involved.

To begin, you’ll need to educate yourself on the fundamentals of blockchain technology, the different types of cryptocurrencies, and the various trading platforms available. You’ll also need to set up a digital wallet to store your cryptocurrencies securely.

Choosing a Reliable Crypto Exchange

When it comes to trading cryptocurrencies, selecting a reputable exchange is crucial. A reliable exchange should offer a user-friendly interface, robust security measures, and a wide range of trading pairs. Some popular exchanges for beginners include Coinbase, Binance, and Kraken. These exchanges provide a seamless trading experience and offer various tools to help you make informed decisions. When choosing an exchange, consider factors such as fees, liquidity, and customer support.

Understanding Crypto Trading Pairs and Orders

To start trading, you’ll need to understand the concept of trading pairs and orders. A trading pair represents the two assets being exchanged, such as BTC/USDT (Bitcoin/Tether). You’ll also need to familiarize yourself with different types of orders, including market orders, limit orders, and stop-loss orders. Understanding these concepts will help you navigate the trading process and make more informed decisions.

Managing Risk and Developing a Trading Strategy

As a beginner, it’s essential to manage risk and develop a trading strategy that suits your goals and risk tolerance. This includes setting stop-loss orders, limiting your position sizes, and diversifying your portfolio. You should also stay up-to-date with market news and analysis to make informed decisions. A well-thought-out strategy will help you navigate the volatile cryptocurrency market and minimize potential losses.

| Exchange | Fees | Liquidity | Security |

|---|---|---|---|

| Coinbase | 1.49% – 3.99% | High | Strong |

| Binance | 0.1% – 0.5% | Very High | Strong |

| Kraken | 0.16% – 0.26% | High | Strong |

Is $100 enough to start crypto?

Is Crypto Trading Still Profitable in 2025?

Is Crypto Trading Still Profitable in 2025?The amount of money required to start investing in cryptocurrency can vary greatly depending on several factors, including the type of cryptocurrency, the exchange or platform used, and the individual’s investment goals. While $100 can be a good starting point, it’s essential to understand that the cryptocurrency market can be highly volatile, and there are risks involved.

Understanding the Minimum Investment Requirements

To determine if $100 is enough to start investing in cryptocurrency, it’s crucial to understand the minimum investment requirements for various exchanges and platforms. Some exchanges have minimum deposit requirements, while others may have minimum trade amounts.

- The minimum deposit requirement can range from $10 to $100 or more, depending on the exchange and payment method.

- Some exchanges may not have a minimum deposit requirement, but may have a minimum trade amount, which can be as low as $1.

- It’s also important to consider the fees associated with depositing and withdrawing funds, as these can eat into the initial investment.

Assessing the Potential Returns on Investment

When considering investing $100 in cryptocurrency, it’s essential to assess the potential returns on investment. The cryptocurrency market is known for its volatility, and prices can fluctuate rapidly.

- The potential returns on investment in cryptocurrency can be substantial, with some coins experiencing gains of 100% or more in a short period.

- However, the risk of losses is also high, and investors may lose some or all of their initial investment.

- It’s crucial to do thorough research and consider a diversified investment portfolio to minimize risk.

Managing Risk with a Limited Budget

Investing in cryptocurrency with a limited budget of $100 requires careful risk management. It’s essential to understand that the cryptocurrency market can be unpredictable, and prices may fluctuate rapidly.

- To manage risk, investors can consider diversifying their portfolio by investing in multiple cryptocurrencies.

- It’s also essential to set a budget and stick to it, to avoid investing more than can be afford to lose.

- Investors should also consider using stop-loss orders and other risk management tools to limit potential losses.

How much is $1000 worth in crypto?

The value of $1000 in cryptocurrency can fluctuate rapidly due to the volatile nature of the crypto market. To determine its worth, we need to consider the current prices of various cryptocurrencies.

Cryptocurrency Prices and Conversion Rates

The value of $1000 in crypto depends on the type of cryptocurrency and its current market price. For instance, if we consider Bitcoin, the largest cryptocurrency by market capitalization, the conversion rate can be calculated based on its current price.

- The current price of Bitcoin is subject to change every minute, so it’s essential to check the latest price.

- If the current price of Bitcoin is $30,000, then $1000 can be converted to approximately 0.0333 BTC.

- The value of 0.0333 BTC can fluctuate based on the future price movements of Bitcoin.

Factors Affecting Cryptocurrency Prices

The prices of cryptocurrencies are influenced by a variety of factors, including market demand, adoption rates, and global economic conditions. Understanding these factors can help in making informed decisions about investing in cryptocurrencies.

Why Is Bitcoin Going Up (or Down) Right Now?

Why Is Bitcoin Going Up (or Down) Right Now?- Market demand and supply play a crucial role in determining cryptocurrency prices.

- Regulatory changes and government policies can significantly impact cryptocurrency prices.

- Technological advancements and security concerns can also affect the value of cryptocurrencies.

Popular Cryptocurrencies and Their Conversion Rates

Different cryptocurrencies have different conversion rates based on their current market prices. Some popular cryptocurrencies include Ethereum, Litecoin, and Bitcoin Cash, among others.

- Ethereum is the second-largest cryptocurrency by market capitalization and has a significant following.

- If the current price of Ethereum is $2000, then $1000 can be converted to approximately 0.5 ETH.

- The conversion rates for other cryptocurrencies can be calculated similarly based on their current market prices.

Which crypto trading is best for beginners?

For beginners, the best crypto trading option is typically considered to be a simple and straightforward method that involves minimal risk and complexity. One such option is buying and holding cryptocurrencies on a reputable exchange. This involves purchasing a cryptocurrency and holding onto it for a period of time, with the expectation that its value will increase.

Choosing the Right Exchange

When it comes to buying and holding cryptocurrencies, the choice of exchange is crucial. A good exchange should be reputable, secure, and easy to use.

It is also essential to consider the fees associated with trading on the exchange.

Some key factors to consider when choosing an exchange include:

- The range of cryptocurrencies available for trading

- The security measures in place to protect user funds

- The fees associated with deposits, withdrawals, and trading

Popular Cryptocurrencies for Beginners

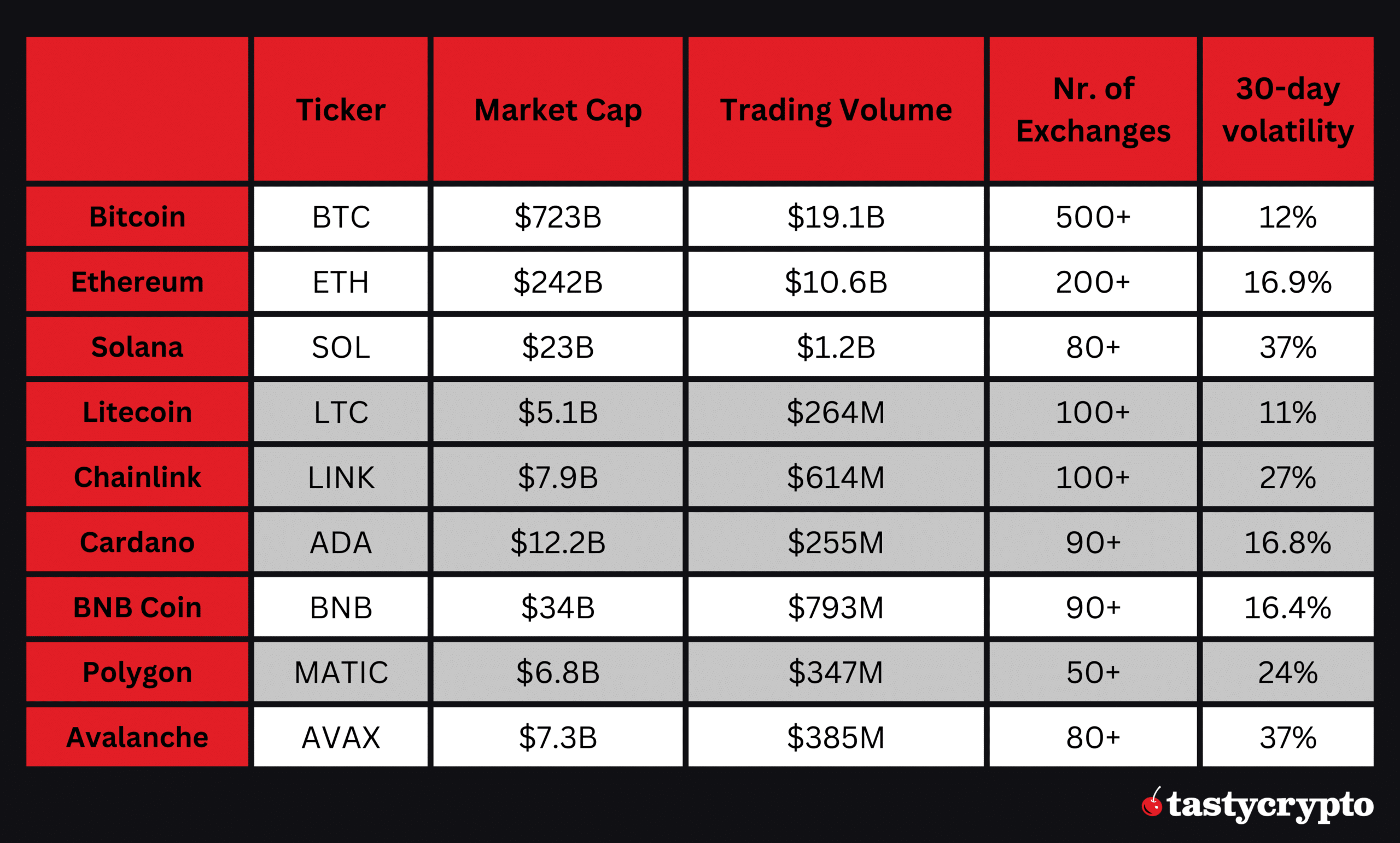

For those new to crypto trading, it is often recommended to start with well-established and widely recognized cryptocurrencies.

These cryptocurrencies tend to be less volatile and more liquid than some of the more obscure options.

Some popular cryptocurrencies for beginners include:

- Bitcoin, the most widely recognized and widely held cryptocurrency

- Ethereum, a popular cryptocurrency with a large and active developer community

- Litecoin, a fast and secure cryptocurrency that is often used for transactions

Key Considerations for Crypto Trading

Regardless of the specific cryptocurrency or exchange chosen, there are several key considerations that beginners should be aware of when it comes to crypto trading.

These include the potential for significant price volatility, the risk of security breaches, and the need to stay informed about market trends.

Some key considerations for crypto trading include:

- Understanding the risks associated with crypto trading and taking steps to mitigate them

- Staying informed about market trends and developments

- Being aware of the fees associated with trading and other activities on the exchange

Frequently Asked Questions

What is cryptocurrency trading and how does it work?

Cryptocurrency trading involves buying and selling digital currencies on online platforms. It works similarly to traditional stock trading, but with cryptocurrencies like Bitcoin or Ethereum. Traders speculate on price movements, using exchanges to buy or sell. Prices can be highly volatile, and trading involves risk. Understanding market trends and using risk management strategies are key.

How do I choose a cryptocurrency exchange as a beginner?

To choose a cryptocurrency exchange, consider factors like security, fees, and user interface. Look for exchanges with good reputations, strong security measures, and transparent fee structures. Popular exchanges for beginners include Coinbase, Binance, and Kraken. Read reviews and do your research to find an exchange that meets your needs and is easy to use.

Which Crypto Wallet Is Safest for Long-Term Storage?

Which Crypto Wallet Is Safest for Long-Term Storage?What are the basic steps to start trading cryptocurrency?

To start trading cryptocurrency, first create an account on a reputable exchange. Verify your identity and deposit funds. Familiarize yourself with the exchange’s trading interface and tools. Develop a trading strategy, and consider starting with small amounts to minimize risk. It’s also essential to stay informed about market trends and news that could impact cryptocurrency prices.

How much money do I need to start trading cryptocurrency?

The amount of money needed to start trading cryptocurrency varies. Some exchanges have low or no minimum deposit requirements, while others may require more. You can start with a small amount, such as $100 or less, and gradually increase your investment as you gain experience. Be aware that trading involves risk, and you should only invest what you can afford to lose.