The rise of cryptocurrencies has led to a significant increase in tax-related queries among investors and traders. As governments worldwide grapple with regulating digital assets, understanding tax obligations has become crucial. In the US and UK, tax authorities have established guidelines for cryptocurrency taxation. This article explores how crypto taxes work in these two countries, highlighting key differences and similarities.

It examines the tax implications of buying, selling, and trading cryptocurrencies, providing clarity on the complex tax landscape. Taxpayers will gain insight into their obligations and the necessary steps to ensure compliance.

Understanding Crypto Taxes in the US and UK: A Comparative Overview

The taxation of cryptocurrency is a complex and evolving area, with both the United States and the United Kingdom having their own set of rules and regulations. In both countries, the tax treatment of cryptocurrency is based on its classification as a form of property or asset, rather than as a currency.

This classification has significant implications for how gains and losses from cryptocurrency are taxed.

Tax Classification of Cryptocurrency

In the US, the Internal Revenue Service (IRS) classifies cryptocurrency as a capital asset, subject to capital gains tax. This means that gains or losses from the sale or exchange of cryptocurrency are treated as capital gains or losses. Similarly, in the UK, Her Majesty’s Revenue and Customs (HMRC) treats cryptocurrency as a taxable asset, with gains subject to Capital Gains Tax (CGT). The classification as a capital asset or taxable asset has a significant impact on how cryptocurrency is taxed in both countries.

Tax Implications for Crypto Investors

For investors in cryptocurrency, understanding the tax implications is crucial. In the US, if an investor holds cryptocurrency for less than one year before selling, the gain is considered a short-term capital gain and is taxed at the investor’s ordinary income tax rate. If held for more than one year, the gain is considered a long-term capital gain and is taxed at a lower rate. In the UK, the tax implications depend on whether the gain is considered taxable income or subject to CGT. The UK also has an annual exempt amount for CGT, which can affect the amount of tax payable.

Reporting Crypto Taxes

Reporting cryptocurrency taxes can be complex, with both countries requiring taxpayers to keep detailed records of their transactions. In the US, taxpayers must report gains and losses on Form 8949 and Schedule D of their tax return. In the UK, taxpayers must report their gains on their Self Assessment tax return. The following table summarizes the key differences in reporting requirements:

| Country | Reporting Form/Section | Key Requirements |

|---|---|---|

| US | Form 8949 and Schedule D | Detailed records of transactions, including date acquired, date sold, and gain or loss |

| UK | Self Assessment tax return | Reporting of taxable gains, with records of transactions, including date of acquisition and proceeds from disposal |

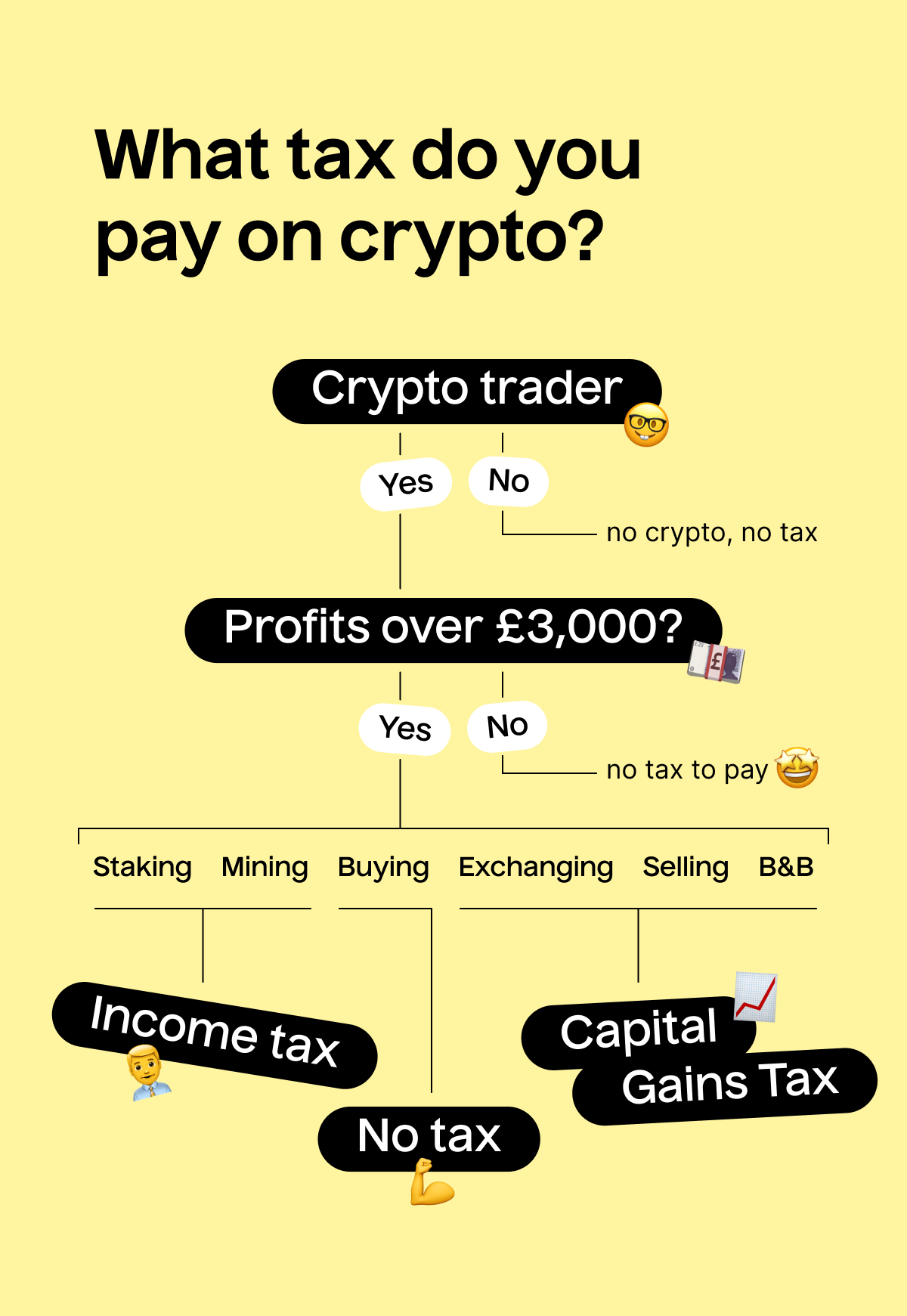

Do I pay tax on my cryptocurrency in the UK?

In the UK, the tax treatment of cryptocurrency is a complex issue that depends on several factors, including the type of cryptocurrency, the purpose of the transaction, and the individual’s tax status. The UK tax authority, HMRC, views cryptocurrency as a form of property for tax purposes, rather than as a currency. This means that cryptocurrency is subject to capital gains tax (CGT) when it is sold or exchanged for another asset.

Tax Implications of Cryptocurrency Trading

When trading cryptocurrency, individuals are subject to CGT on any gains made. The gain is calculated by subtracting the cost of acquiring the cryptocurrency from the sale price. If the gain is subject to CGT, it must be reported on the individual’s self-assessment tax return. The tax implications of cryptocurrency trading can be complex, and individuals should consider the following:

What’s the Difference Between Spot and Futures Trading in Crypto?

What’s the Difference Between Spot and Futures Trading in Crypto?- The CGT allowance, which is the amount of gain that can be made before CGT is payable

- The tax rate applicable to the gain, which depends on the individual’s income tax band

- The need to keep accurate records of all cryptocurrency transactions to ensure accurate tax reporting

Tax Treatment of Cryptocurrency Mining

Cryptocurrency mining is considered a business activity by HMRC, and individuals who mine cryptocurrency are subject to income tax on their profits. The profits are calculated by subtracting the costs associated with mining, such as equipment and electricity, from the value of the cryptocurrency mined. Individuals who mine cryptocurrency should consider the following:

- The need to register with HMRC as self-employed and complete a self-assessment tax return

- The requirement to pay Class 2 and Class 4 National Insurance Contributions on their mining profits

- The need to keep accurate records of all mining income and expenses to ensure accurate tax reporting

Reporting Cryptocurrency Gains on Your Tax Return

Individuals who have made gains on cryptocurrency must report these gains on their self-assessment tax return. The gain is reported on the capital gains tax section of the return, and the individual must provide details of the gain, including the date of acquisition and disposal, and the amount of the gain. Individuals should consider the following:

- The need to complete the capital gains tax section of the self-assessment tax return accurately and in full

- The requirement to pay any CGT due by the relevant deadline to avoid penalties and interest

- The need to keep accurate records of all cryptocurrency transactions to ensure accurate tax reporting in future years

How much does crypto get taxed in the USA?

In the United States, the taxation of cryptocurrency is governed by the Internal Revenue Service (IRS) and is considered property for tax purposes. This classification means that cryptocurrency is subject to capital gains tax when sold. The tax rate applied to cryptocurrency gains depends on the taxpayer’s income tax bracket and the length of time they held the cryptocurrency.

Tax Rates for Cryptocurrency Gains

The tax rate for cryptocurrency gains is determined by the taxpayer’s income level and the duration for which they held the cryptocurrency. If the cryptocurrency was held for less than a year, the gain is considered a short-term capital gain and is taxed at the taxpayer’s ordinary income tax rate. If held for more than a year, it is considered a long-term capital gain and is taxed at a lower rate.

- The tax rates for long-term capital gains are 0%, 15%, or 20%, depending on the taxpayer’s taxable income.

- For taxpayers in the highest tax bracket, the long-term capital gains rate is 20%.

- For taxpayers in lower tax brackets, the rate can be as low as 0% for long-term capital gains.

Reporting Cryptocurrency Income

Taxpayers are required to report their cryptocurrency transactions on their tax returns. This includes reporting gains or losses from the sale of cryptocurrency, as well as income received from cryptocurrency mining or other sources. The IRS requires taxpayers to report their cryptocurrency income on Form 1040 and to complete Form 8949 to detail their capital gains and losses.

- Taxpayers must report the date acquired, date sold, proceeds from the sale, and cost basis for each cryptocurrency transaction.

- They must also calculate their gain or loss for each transaction and report the total on Schedule D of their tax return.

- Accurate record-keeping is crucial for taxpayers to correctly report their cryptocurrency transactions.

Tax Implications of Cryptocurrency Mining

Cryptocurrency mining is considered a taxable activity in the United States. The IRS considers the income received from mining to be taxable as ordinary income. This means that taxpayers must report the fair market value of the cryptocurrency mined as income on their tax return.

- The fair market value of the cryptocurrency is determined by its value on the day it was received.

- Taxpayers may also be able to deduct expenses related to their mining activities, such as equipment costs and electricity.

- Self-employment tax may apply if the mining activity is considered a trade or business.

What happens if you don’t declare crypto gains in the UK?

In the UK, the HM Revenue & Customs (HMRC) requires individuals to report and pay tax on their cryptocurrency gains. Failure to declare these gains can result in penalties and fines. If an individual fails to declare their cryptocurrency gains, HMRC may impose penalties, interest on the tax owed, and potentially even initiate a tax investigation.

Penalties for Undeclared Crypto Gains

The penalties for undeclared crypto gains can be severe. If HMRC discovers that an individual has failed to declare their cryptocurrency gains, they may be liable for a penalty of up to 200% of the tax owed. The penalty amount will depend on the individual’s circumstances and whether the failure to declare was deemed careless or deliberate.

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTube

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTube- The penalty for careless behavior is typically between 0% and 30% of the tax owed.

- If the failure to declare is deemed deliberate, the penalty can be between 20% and 70% of the tax owed.

- In cases where the failure to declare is deemed deliberate and concealed, the penalty can be between 30% and 100% of the tax owed.

Consequences of a Tax Investigation

If HMRC initiates a tax investigation into an individual’s undeclared cryptocurrency gains, it can be a lengthy and costly process. The individual may be required to provide detailed financial records and may be subject to interviews with HMRC officials.

- A tax investigation can result in significant financial penalties and fines.

- The individual may also be required to pay interest on the tax owed, which can add up quickly.

- In severe cases, HMRC may initiate criminal proceedings against the individual.

Voluntary Disclosure and Amnesty

If an individual has failed to declare their cryptocurrency gains, they may be able to avoid penalties by making a voluntary disclosure to HMRC. This can be done through the Worldwide Disclosure Facility (WDF) or by contacting HMRC directly.

- Making a voluntary disclosure can help to reduce or avoid penalties.

- The individual will still be required to pay the tax owed, plus interest.

- HMRC may still initiate a tax investigation, even if a voluntary disclosure is made.

Can I claim crypto losses on taxes in the UK?

In the UK, cryptocurrency is considered an asset for tax purposes, and losses incurred from the sale or disposal of cryptocurrency can be claimed against capital gains tax. The UK’s HM Revenue & Customs (HMRC) treats cryptocurrency transactions similarly to other investment transactions, such as buying and selling shares.

Understanding Crypto Losses for Tax Purposes

To claim crypto losses on taxes, it’s essential to understand what constitutes a loss. A loss occurs when you dispose of a cryptocurrency for less than its original purchase price or its value at the time of acquisition. This can happen due to market fluctuations or if you sell your cryptocurrency at a lower price than you bought it for.

- Keep accurate records of all cryptocurrency transactions, including dates, amounts, and values.

- Calculate the loss by comparing the disposal proceeds to the original cost or value.

- Report the loss on your Self Assessment tax return.

Reporting Crypto Losses on Your Tax Return

To claim crypto losses, you’ll need to report them on your Self Assessment tax return. You’ll need to complete the capital gains section of the tax return and calculate the total gains or losses from all your investments, including cryptocurrency. If your total losses exceed your total gains, you can carry forward the excess losses to offset against future gains.

- Complete the capital gains section of your Self Assessment tax return.

- Calculate the total gains or losses from all your investments.

- Carry forward excess losses to offset against future gains.

Key Considerations for Claiming Crypto Losses

When claiming crypto losses, there are several key considerations to keep in mind. You should be aware of the tax rules and regulations surrounding cryptocurrency, as well as any potential restrictions or limitations on claiming losses.

- Be aware of the tax rules and regulations surrounding cryptocurrency.

- Understand the distinction between capital gains and income tax.

- Keep accurate records to support your loss claims.

Frequently Asked Questions

What are the tax implications of cryptocurrency in the US?

The US treats cryptocurrency as property for tax purposes. Gains or losses from cryptocurrency transactions are subject to capital gains tax. Taxpayers must report income from cryptocurrency mining, trading, and sales on their tax returns. The IRS requires taxpayers to report gains or losses on Form 8949 and Schedule D. Tax rates vary depending on the holding period and taxpayer’s income tax bracket.

How does the UK tax authority treat cryptocurrency for tax purposes?

HMRC treats cryptocurrency as an asset for tax purposes. Gains from cryptocurrency transactions are subject to capital gains tax. Taxpayers must report gains on their Self Assessment tax return. The tax rate depends on the taxpayer’s income tax band and the gain made. HMRC also requires taxpayers to report income from cryptocurrency mining and trading as taxable income.

Do I need to report cryptocurrency losses on my tax return in the US or UK?

Yes, taxpayers in both the US and UK must report cryptocurrency losses on their tax returns. In the US, losses are reported on Form 8949 and Schedule D, and can be used to offset gains. In the UK, losses are reported on the Self Assessment tax return and can be used to offset gains in the same tax year or carried forward to future years.

El Reto del Yate: lujo, aspiración y la fantasía viral que dominó las redes sociales

El Reto del Yate: lujo, aspiración y la fantasía viral que dominó las redes socialesWhat records should I keep to comply with cryptocurrency tax regulations?

Taxpayers should keep detailed records of all cryptocurrency transactions, including dates, amounts, and values. This includes records of purchases, sales, trades, and mining income. In the US, taxpayers should also keep records of the holding period and gain or loss calculations. In the UK, taxpayers should keep records of the acquisition and disposal of cryptocurrency assets, including the date and value of the transaction.