The world of cryptocurrency is known for its volatility, with prices fluctuating wildly and unpredictably. As a result, investors are often left wondering if they can lose all their money in crypto. The answer is yes, it is possible to lose a significant portion or even all of one’s investment in cryptocurrency.

With the lack of regulation and oversight, cryptocurrency investments carry a high level of risk, making it essential for investors to be aware of the potential pitfalls and take necessary precautions to mitigate potential losses. Understanding the risks is crucial.

Understanding the Risks of Investing in Cryptocurrency

Investing in cryptocurrency can be a high-risk, high-reward endeavor. The cryptocurrency market is known for its volatility, with prices fluctuating rapidly and unpredictably. This volatility can result in significant losses if not managed properly.

One of the primary concerns for investors is the possibility of losing their entire investment.

The Impact of Market Volatility on Cryptocurrency Investments

Market volatility is a significant risk factor for cryptocurrency investors. The crypto market’s volatility can be attributed to various factors, including changes in market sentiment, regulatory developments, and global economic conditions. As a result, the value of cryptocurrencies can drop sharply, leading to substantial losses for investors who are not prepared.

Factors Contributing to Potential Losses in Cryptocurrency

Several factors contribute to the potential for losses in cryptocurrency investments. These include market manipulation, security risks associated with exchanges and wallets, and the lack of regulatory oversight in some jurisdictions. Understanding these risks is crucial for investors to make informed decisions.

Managing Risk in Cryptocurrency Investments

To mitigate potential losses, investors can adopt various strategies, such as diversifying their portfolios and setting stop-loss orders. Diversification can help spread risk across different assets, while stop-loss orders can limit losses by automatically selling a cryptocurrency when its price falls below a certain threshold.

| Risk Factor | Description | Mitigation Strategy |

|---|---|---|

| Market Volatility | Rapid and unpredictable price fluctuations | Diversification and stop-loss orders |

| Security Risks | Potential for hacking and theft | Using secure exchanges and hardware wallets |

| Regulatory Risks | Changes in regulations affecting cryptocurrency value | Staying informed about regulatory developments |

Is it possible to lose all money in crypto?

The answer is yes, it is possible to lose all your money in cryptocurrency. Cryptocurrency investments are known for their high volatility, and the market can be unpredictable. There are several factors that can contribute to losing all your money in crypto, including market fluctuations, security risks, and investment decisions.

Risks Associated with Cryptocurrency Investments

Investing in cryptocurrency comes with several risks that can lead to significant financial losses. One of the primary risks is the high volatility of the cryptocurrency market, which can result in rapid price fluctuations. Additionally, the lack of regulation and oversight in the cryptocurrency space can make it difficult to recover lost or stolen funds. Some of the key risks associated with cryptocurrency investments include:

How Do Crypto Taxes Work in the US and UK?

How Do Crypto Taxes Work in the US and UK?- Market volatility: Cryptocurrency prices can fluctuate rapidly, resulting in significant losses if not managed properly.

- Security risks: Cryptocurrency exchanges, wallets, and transactions can be vulnerable to hacking and other security threats.

- Lack of regulation: The cryptocurrency market is largely unregulated, making it difficult to recover lost or stolen funds.

Common Mistakes that Can Lead to Financial Losses

There are several common mistakes that investors make when investing in cryptocurrency, which can lead to significant financial losses. These mistakes include failing to diversify their investment portfolio, investing more than they can afford to lose, and not doing their research before making an investment. Some of the key mistakes to avoid when investing in cryptocurrency include:

- Failing to diversify: Investing too much in a single cryptocurrency or asset can increase the risk of significant losses.

- Investing more than you can afford: Investing more than you can afford to lose can lead to financial difficulties if the investment does not perform as expected.

- Not doing your research: Failing to research the cryptocurrency and its underlying technology can lead to poor investment decisions.

Best Practices for Managing Risk

To minimize the risk of losing all your money in cryptocurrency, it’s essential to follow best practices for managing risk. This includes diversifying your investment portfolio, setting clear investment goals, and staying informed about market developments. Some of the key best practices for managing risk when investing in cryptocurrency include:

- Diversifying your portfolio: Spreading your investments across different asset classes and cryptocurrencies can help to minimize risk.

- Setting clear investment goals: Establishing clear investment goals and risk tolerance can help to guide your investment decisions.

- Staying informed: Staying up-to-date with market developments and news can help to inform your investment decisions and minimize risk.

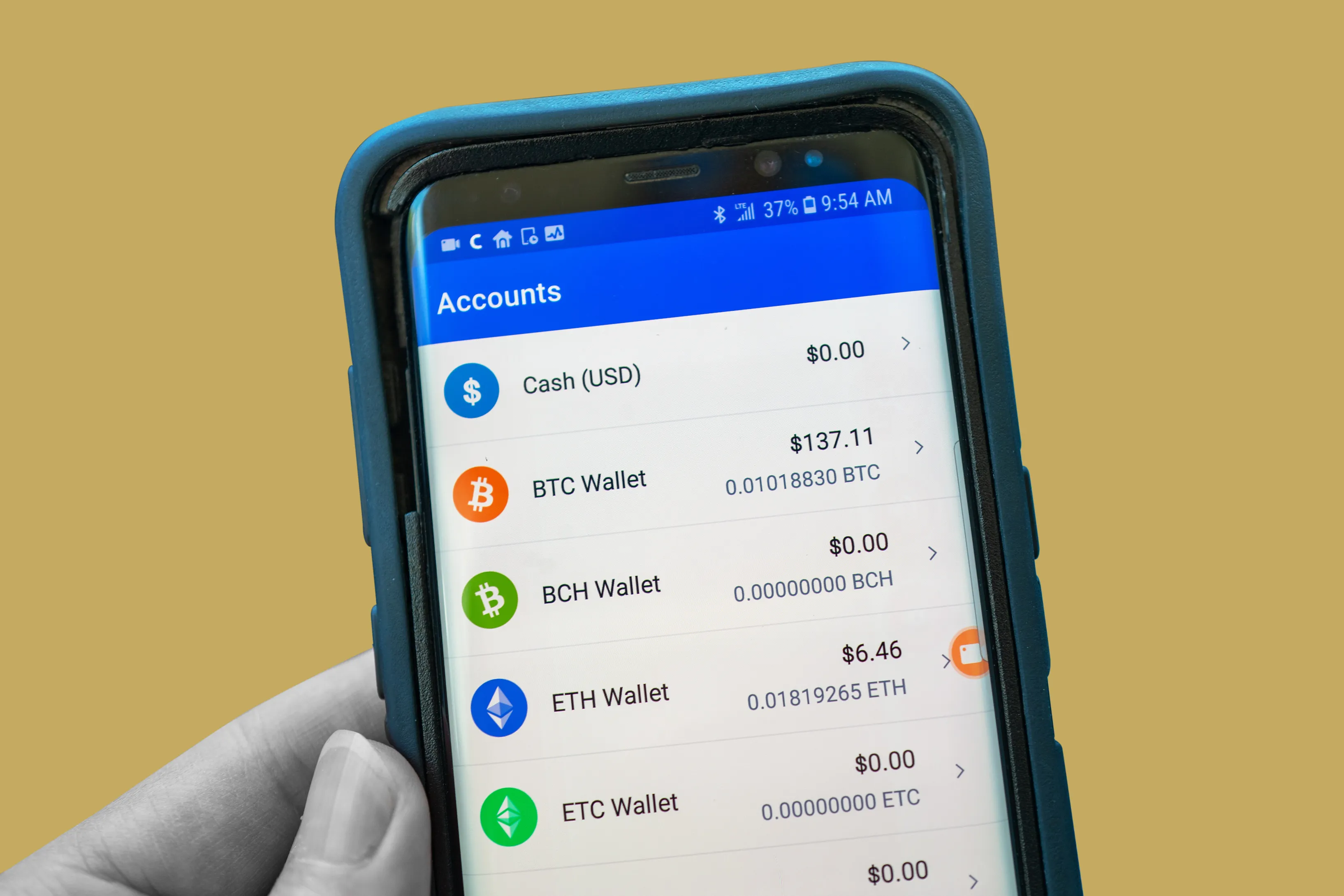

Is it hard to get your money out of crypto?

The process of withdrawing or cashing out cryptocurrency can be complex and may involve several steps, depending on the exchange, wallet, or platform being used. The ease of getting money out of crypto largely depends on the liquidity of the cryptocurrency, the policies of the exchange or custodian, and the regulatory environment.

Understanding Withdrawal Processes

The withdrawal process typically involves transferring cryptocurrencies from an exchange or a wallet to a bank account or another payment method. This can be straightforward for those familiar with the process, but it may pose challenges for newcomers. The steps and requirements can vary significantly between different platforms.

- Verification processes are often required to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Transaction fees can apply, and the amount may vary depending on the cryptocurrency and the network congestion.

- Processing times can range from a few minutes to several days, influenced by factors such as the blockchain’s transaction processing time and the exchange’s internal procedures.

Factors Affecting Liquidity and Accessibility

The liquidity of a cryptocurrency and the accessibility of funds can be affected by several factors, including market volatility, the cryptocurrency’s trading volume, and the exchange’s liquidity. In times of high market volatility or low liquidity, it may be more difficult to cash out quickly or at a favorable price.

- Market conditions can significantly impact the ability to sell or exchange cryptocurrencies at a desired price.

- The reputation and reliability of the exchange or custodian play a crucial role in ensuring that funds are accessible and secure.

- Regulatory changes or restrictions can impact the ease of withdrawing or using cryptocurrencies.

Navigating Fees and Exchange Rates

Fees associated with withdrawing cryptocurrencies or converting them to fiat currency can eat into the value of the withdrawal. Understanding the fee structure and exchange rates is crucial to minimize losses.

- Transaction fees on the blockchain can vary, with some cryptocurrencies offering faster transaction times at a higher cost.

- Exchanges and platforms may charge their own fees for withdrawals or conversions, which can add to the overall cost.

- Exchange rates between cryptocurrencies and fiat currencies can fluctuate, affecting the final amount received upon withdrawal.

What if you invested $1000 in Bitcoin 5 years ago?

If you had invested $1000 in Bitcoin 5 years ago, the outcome would be quite remarkable. In August 2018, the price of one Bitcoin was around $6,384. So, with $1000, you could have bought approximately 0.1567 Bitcoins. Fast forward to the present day, the price of Bitcoin has fluctuated but overall, it has seen a significant increase. As of now, one Bitcoin is worth around $27,000. Thus, your initial investment of $1000 would be worth approximately $4,233.

Understanding the Investment

Investing in Bitcoin is a high-risk, high-reward endeavor. It’s essential to understand that the cryptocurrency market is known for its volatility. When you invested $1000 in Bitcoin 5 years ago, you were taking a risk, but you were also potentially setting yourself up for substantial gains. Some key points to consider about investing in Bitcoin include:

What’s the Difference Between Spot and Futures Trading in Crypto?

What’s the Difference Between Spot and Futures Trading in Crypto?- The cryptocurrency market operates 24/7, and prices can fluctuate rapidly.

- Bitcoin’s value can be influenced by a variety of factors, including regulatory changes and market sentiment.

- Past performance is not a guarantee of future results, and investing in Bitcoin carries inherent risks.

Potential Outcomes

The potential outcomes of investing $1000 in Bitcoin 5 years ago could have varied greatly depending on when you sold your investment. If you had sold your Bitcoins during the peak in 2021, you would have seen a much higher return on investment. Some possible scenarios to consider:

- If you sold your Bitcoins at the peak price in 2021, your $1000 investment could have been worth over $10,000.

- If you held onto your investment and sold it at the current price, you would still be looking at a significant profit.

- If you had sold your investment during one of the market downturns, you might have seen a loss, highlighting the importance of timing in cryptocurrency investments.

Long-term Investment Strategy

Adopting a long-term investment strategy can be a viable approach when investing in Bitcoin. By holding onto your investment over an extended period, you can potentially ride out market fluctuations and benefit from overall growth. Key considerations for a long-term investment strategy include:

- Having a clear understanding of your investment goals and risk tolerance.

- Being prepared to hold onto your investment for an extended period, despite market volatility.

- Continuously monitoring and adjusting your investment strategy as needed to align with your financial objectives.

Can you lose money if you buy crypto?

Yes, it is possible to lose money if you buy cryptocurrency. The cryptocurrency market is known for its volatility, and the value of your investment can fluctuate rapidly. If you buy cryptocurrency at a high price and the market price drops, you may end up selling it at a lower price, resulting in a loss.

Understanding the Risks

The cryptocurrency market is subject to various risks that can affect the value of your investment. One of the primary risks is market volatility, which can be caused by a range of factors, including changes in supply and demand, regulatory developments, and security concerns. To mitigate these risks, it’s essential to understand the underlying factors that drive the market.

- Market volatility can result in significant losses if you’re not prepared.

- Regulatory changes can impact the value of your investment.

- Security concerns, such as hacking and theft, can also affect the value of your investment.

Factors that Contribute to Losses

Several factors can contribute to losses when buying cryptocurrency. One of the primary factors is the lack of regulation in the market, which can make it difficult to recover lost funds. Additionally, the market’s volatility can be exacerbated by speculation and hype, leading to rapid price fluctuations. It’s crucial to be aware of these factors to make informed investment decisions.

- Lack of regulation can make it challenging to recover lost funds.

- Speculation and hype can drive price fluctuations.

- Market sentiment can also impact the value of your investment.

Minimizing Potential Losses

While it’s impossible to eliminate the risk of losses entirely, there are steps you can take to minimize potential losses. One approach is to diversify your investment portfolio by investing in a range of assets, including other cryptocurrencies and traditional investments. Additionally, setting a budget and sticking to it can help you avoid over-investing in the market.

- Diversifying your investment portfolio can help spread risk.

- Setting a budget can help you avoid over-investing.

- Staying informed about market developments can also help you make better investment decisions.

Frequently Asked Questions

What are the risks associated with investing in cryptocurrency?

Investing in cryptocurrency is highly volatile and subject to significant price fluctuations. Market speculation, regulatory changes, and security risks can lead to substantial losses. Investors may lose some or all of their investment, and there’s a risk of total loss if the cryptocurrency becomes worthless or is affected by unforeseen events.

Can I lose more money than I invest in crypto?

Yes, it is possible to lose more money than you invest in crypto, particularly if you engage in margin trading or other leveraged investment strategies. These strategies involve borrowing funds to amplify potential gains, but they also amplify potential losses. If the market moves against your position, you may be required to repay the borrowed amount, leading to significant financial losses.

How can I minimize the risk of losing money in crypto?

To minimize the risk of losing money in crypto, it’s essential to conduct thorough research, diversify your investment portfolio, and set clear investment goals. Investors should also be cautious of unsolicited investment advice, be aware of market volatility, and never invest more than they can afford to lose. Using reputable exchanges and storing assets securely can also help mitigate potential losses.

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTube

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTubeIs it possible to recover lost cryptocurrency funds?

Recovering lost cryptocurrency funds can be challenging, as transactions are typically irreversible. If you’ve lost access to your wallet or have been a victim of a scam, you may be able to recover some or all of your funds by contacting the exchange or wallet provider, or seeking professional assistance. However, the likelihood of recovery depends on the specific circumstances surrounding the loss.