Saving money is a crucial aspect of achieving financial stability and securing a prosperous future. With the rising costs of living and expenses, it can be challenging to manage one’s finances effectively. However, by implementing a few simple strategies, individuals can significantly reduce their expenditure and accumulate wealth over time. This article provides practical tips and expert advice on how to save more money, covering various aspects such as budgeting, cutting costs, and making smart financial decisions. By following these guidelines, readers can take the first step towards a more financially secure tomorrow.

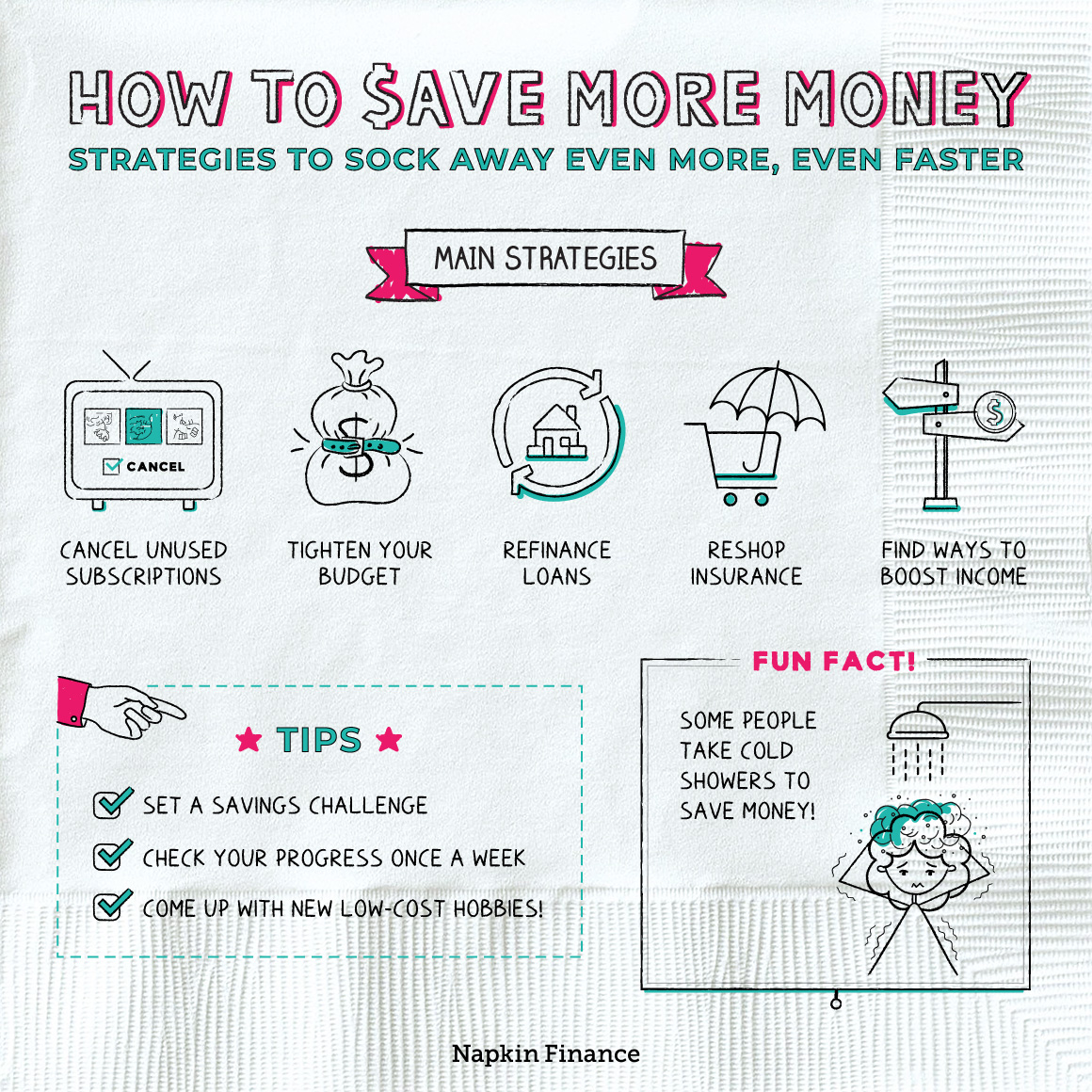

Effective Strategies to Boost Your Savings

Saving money is a crucial aspect of financial planning, and implementing the right strategies can make a significant difference in your ability to accumulate wealth over time. By making a few simple changes to your financial habits, you can maximize your savings and achieve your long-term financial goals.

Track Your Expenses

Monitoring where your money is going is essential to understanding how you can save more. By keeping a record of every purchase, no matter how small, you can identify areas where you can cut back on unnecessary spending. This will allow you to allocate your funds more efficiently and make conscious decisions about how you want to use your money.

Automate savings to reach goals faster

Automate savings to reach goals fasterCreate a Budget

A well-structured budget is the foundation of any successful savings plan. By categorizing your expenses into needs and wants, you can prioritize your spending and ensure that you’re not overspending in any one area. A budget also helps you to set realistic savings goals and make adjustments as needed to stay on track.

Automate Your Savings

One of the most effective ways to save money is to automate the process. By setting up automatic transfers from your checking account to your savings or investment accounts, you can make saving easier and less prone to being neglected. This way, you’ll ensure that you’re consistently setting aside a portion of your income, even if you don’t think about it.

| Savings Strategy | Description | Benefits |

|---|---|---|

| 50/30/20 Rule | Allocate 50% of your income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment. | Simplifies budgeting and ensures a significant portion is saved. |

| Automated Transfers | Set up automatic transfers from your checking account to your savings or investment accounts. | Ensures consistent saving and reduces the likelihood of neglecting to save. |

| Expense Tracking | Monitor every purchase to understand where your money is going. | Identifies areas for reduction in unnecessary spending. |

Frequently Asked Questions

How can I start saving more money?

To start saving more money, begin by tracking your expenses to understand where your money is going. Create a budget that accounts for all necessary expenses, and then identify areas where you can cut back. Set financial goals, such as saving for a specific purpose or building an emergency fund, and allocate a portion of your income towards achieving these goals.

Track your savings progress every month

Track your savings progress every monthWhat are some effective ways to reduce daily expenses?

Reducing daily expenses can be achieved by adopting simple habits such as cooking at home instead of eating out, canceling subscription services not in use, and shopping during sales. Additionally, using cashback and rewards credit cards for daily purchases can also help accumulate savings over time. Being mindful of spending habits and making small changes can lead to significant savings.

How can I avoid impulse purchases?

Avoiding impulse purchases requires discipline and a clear understanding of your financial goals. Create a 30-day waiting period for non-essential purchases to help determine if they are truly necessary. Removing shopping apps from your phone and avoiding shopping when emotional can also reduce the likelihood of making impulse buys. Sticking to a shopping list can further help in avoiding unnecessary purchases.

Can saving money become a habit?

Saving money can indeed become a habit with consistent practice and the right mindset. By automating savings through direct transfers from your checking account to your savings or investment accounts, you can make saving easier and less prone to being neglected. Regularly reviewing and adjusting your savings plan can also help in maintaining the habit and achieving long-term financial goals.

El Reto Rosa Neón: la estética viral que convirtió el color en protagonista absoluto de las redes sociales

El Reto Rosa Neón: la estética viral que convirtió el color en protagonista absoluto de las redes sociales