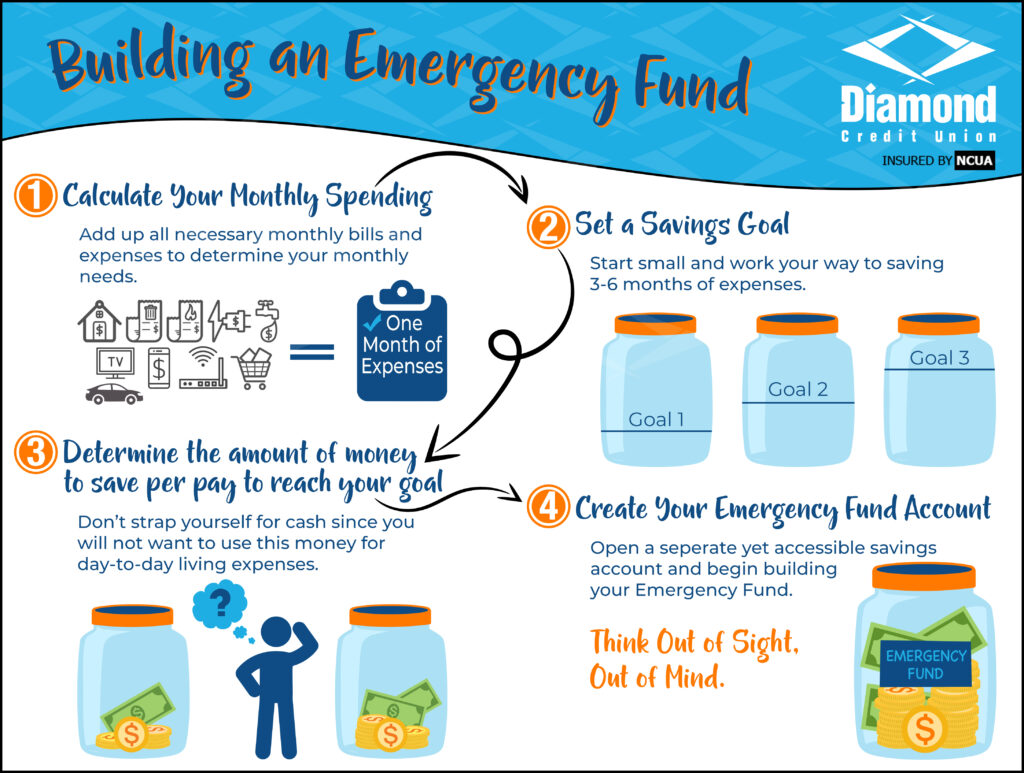

Having a safety net is crucial in today’s uncertain financial landscape. Unexpected expenses and financial downturns can occur at any moment, leaving individuals and families vulnerable to financial strain. Creating an emergency fund is a vital step in ensuring financial security and stability. By setting aside a portion of one’s income in a readily accessible savings account, individuals can mitigate the impact of financial shocks and avoid going into debt. A well-stocked emergency fund provides peace of mind and serves as a foundation for long-term financial well-being, allowing individuals to weather financial storms with confidence.

Building a Safety Net: The Importance of Emergency Funds for Financial Security

Creating an emergency fund is a crucial step in achieving financial security. It serves as a cushion against unexpected expenses, job loss, or other financial setbacks, ensuring that you can maintain your standard of living even in turbulent times. By having a readily accessible savings account dedicated to emergencies, you can avoid going into debt when unforeseen expenses arise.

Determining the Right Amount for Your Emergency Fund

The amount you should save in your emergency fund varies based on factors such as your income, expenses, job security, and dependents. A general rule of thumb is to save enough to cover three to six months’ worth of living expenses. This amount can provide a sufficient buffer against most financial shocks, giving you time to recover or adjust to new circumstances without significant financial strain. For instance, if your monthly expenses are $3,000, you should aim to save between $9,000 and $18,000.

Save more money with these tips

Save more money with these tipsStrategies for Building Your Emergency Fund

To effectively build your emergency fund, it’s essential to treat it as a priority. Start by allocating a fixed amount each month into a dedicated savings account. Consider setting up an automatic transfer from your checking account to make saving easier and less prone to being neglected. You can also explore other strategies such as cutting back on non-essential expenses, selling items you no longer need, or directing any extra income (like bonuses or tax refunds) towards your emergency fund.

Managing and Maintaining Your Emergency Fund

Once you have established your emergency fund, it’s crucial to manage it wisely. Keep your emergency savings in an easily accessible savings account, such as a high-yield savings account, which can earn you interest while still allowing you to withdraw money when needed. Regularly review your fund to ensure it remains aligned with your current expenses and financial situation. If you use some of the funds, make a plan to replenish them as soon as possible.

| Expense Category | Monthly Amount |

|---|---|

| Rent/Mortgage | $1,500 |

| Utilities | $200 |

| Groceries | $500 |

| Transportation | $300 |

| Total Monthly Expenses | $2,500 |

| Recommended Emergency Fund (3-6 months) | $7,500 – $15,000 |

Frequently Asked Questions

What is an emergency fund?

An emergency fund is a pool of money set aside to cover unexpected expenses, such as car repairs, medical bills, or losing a job. It provides financial security and helps avoid debt. The goal is to save 3-6 months’ worth of living expenses in a readily accessible savings account. This fund helps to mitigate financial shocks and provides peace of mind.

Automate savings to reach goals faster

Automate savings to reach goals fasterHow much should I save in an emergency fund?

The general rule of thumb is to save 3-6 months’ worth of living expenses. However, this amount can vary depending on individual circumstances, such as job security, income stability, and dependents. For example, if you have a volatile income or are self-employed, you may want to save more. Consider your expenses, income, and financial obligations to determine a suitable amount for your emergency fund.

Where should I keep my emergency fund?

It’s essential to keep your emergency fund in a readily accessible savings account, such as a high-yield savings account or a liquid fund. This allows you to withdraw money quickly when needed. Avoid investing your emergency fund in stocks or other volatile assets, as they may be subject to market fluctuations. Consider a savings account with a low minimum balance requirement and easy withdrawal options.

How can I build an emergency fund?

Building an emergency fund requires discipline and consistency. Start by setting a realistic target and allocating a fixed amount each month. Automate your savings by setting up a direct deposit from your paycheck or a recurring transfer from your checking account. Review and adjust your budget to identify areas where you can cut back and allocate more funds to your emergency savings.

Track your savings progress every month

Track your savings progress every month