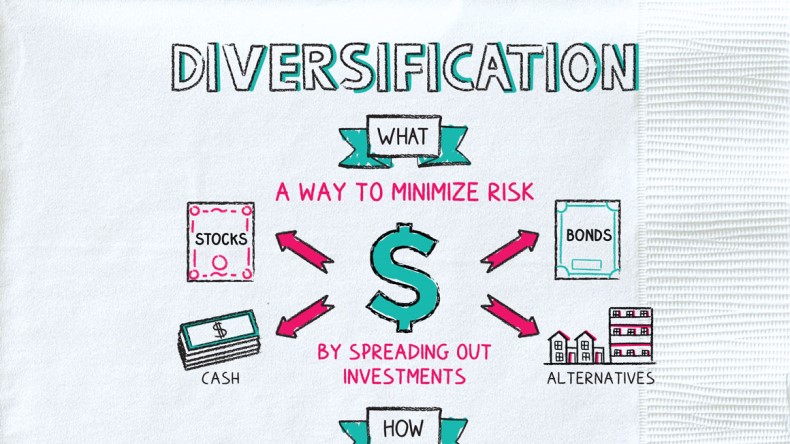

Investing in a single asset or a limited number of assets can be a high-risk strategy, as it leaves you exposed to significant potential losses if the investment performs poorly. Diversifying your investments is a key principle in managing financial risk, as it spreads your money across different asset classes, sectors, and geographic regions. By doing so, you can reduce your reliance on any one particular investment and potentially increase the stability of your returns. A diversified portfolio can help you navigate market volatility and achieve your long-term financial goals more effectively. Effective diversification requires careful planning.

Diversification: The Key to Minimizing Financial Risk

Diversifying investments is a crucial strategy for reducing financial risk. By spreading investments across different asset classes, investors can protect their portfolios from market volatility and potential losses. The idea is to not put all your eggs in one basket, so that if one investment performs poorly, the others can help offset the losses. This approach can lead to more stable returns over time and help investors achieve their long-term financial goals.

Asset Classes for Diversification

Investors can diversify their portfolios by investing in a range of asset classes, including stocks, bonds, real estate, and commodities. Each asset class has its own unique characteristics and risks, and they tend to perform differently in various market conditions. For example, while stocks may be volatile, bonds tend to be more stable, providing a hedge against market downturns. By allocating investments across different asset classes, investors can reduce their exposure to any one particular market.

Learn stock market investing basics now

Learn stock market investing basics nowGeographic Diversification

In addition to diversifying across asset classes, investors can also reduce risk by investing in different geographic regions. This can include investing in emerging markets, such as countries in Asia or Latin America, as well as developed markets, such as the US or Europe. By spreading investments across different regions, investors can benefit from growth opportunities in various parts of the world and reduce their exposure to any one particular market.

Investment Vehicles for Diversification

There are various investment vehicles that can be used to achieve diversification, including index funds, exchange-traded funds (ETFs), and mutual funds. These investment vehicles provide a convenient way to gain exposure to a range of assets with a single investment, making it easier to achieve diversification. They also offer professional management and economies of scale, which can help reduce costs and improve returns.

| Asset Class | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | 8-10% |

| Bonds | Low-Moderate | 4-6% |

| Real Estate | Moderate-High | 6-8% |

| Commodities | High | 8-12% |

Frequently Asked Questions

What is diversification in investing?

Diversification is a strategy used to reduce financial risk by allocating investments across various asset classes, such as stocks, bonds, and real estate. By spreading investments, you can minimize losses from any one particular investment, as different assets perform differently in various market conditions. This helps to create a balanced portfolio that can withstand market fluctuations.

Invest in real estate for stability

Invest in real estate for stabilityWhy is diversifying investments important?

Diversifying investments is crucial because it helps to mitigate potential losses by not putting all your money into a single investment. Different investments react differently to the same economic event, so a diversified portfolio can provide a more stable return over time. This reduces reliance on any one investment and helps to manage overall portfolio risk.

How do I diversify my investments?

To diversify your investments, you can allocate your money across different asset classes, such as stocks, bonds, real estate, and commodities. You can also invest in various geographic regions and industries. Consider using a mix of low-risk and higher-risk investments to balance your portfolio. Regular portfolio rebalancing can also help to maintain an optimal diversification strategy.

Can diversification guarantee investment returns?

Diversification cannot guarantee investment returns or completely eliminate risk. However, it can help to manage risk by spreading investments across different assets. A well-diversified portfolio can provide more consistent returns over time and reduce the impact of market volatility. It’s essential to have realistic expectations and understand that some level of risk is inherent in any investment.

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTube

El Reto del Caramelo: el challenge viral que conquistó TikTok, Instagram y YouTube